If you’ve got your finger on the economic pulse, particularly as it relates to the housing market, you’ve undoubtedly noticed that interest rates are on the rise.

Why? Well, unemployment sits at a low 3.7% (as of October 2018, according to the Bureau of Labor Statistics most recent report) which often comes with higher wages, which leads to inflation, which yields an upward trend in mortgage rates.

The graph below illustrates that correlation pretty well: As unemployment jumped in 2008 and 2009 (the top line), wages dropped significantly (bottom line), followed by a subtle yet steady increase in wages as unemployment slowly falls again.

The Impact on Real Estate

Anyone who pays attention to these types of statistics will gladly give you their opinion on the health and stability of today’s real estate market. And while we’re about to join that club, we don’t suggest that you take our words as gospel. That said, we do believe that the housing market is still incredibly stable and is poised to continue to see continued growth moving forward, particularly in Richmond. Here’s why:

Rising interest rates are caused by and coupled with increased employment, so the increased cost of borrowing is unlikely to cause a collapse. As demonstrated by the low unemployment rate, the public as a whole is seeing their income increase, and provided mortgage credit standards remain consistent (the lack of which was arguably the biggest cause of the 2008 fiasco), these changes are all normal and healthy developments that ebb and flow over time.

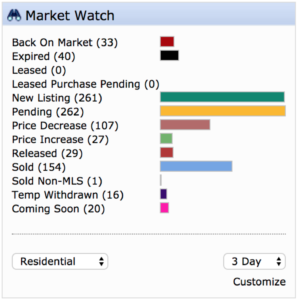

Particularly in Richmond, home values are continuing to rise, making real estate an investment that is likely to produce returns that compensate for higher rates. With houses selling as quickly as they have been, pricing continues to trend upward. This is especially exaggerated in urban markets, where low inventory can’t be easily compensated for by increased building (you can’t build where there aren’t empty lots!). The suburban markets are seeing these trends as well, though pricing is slowly starting to plateau as builders add to the inventory stock.

Particularly in Richmond, home values are continuing to rise, making real estate an investment that is likely to produce returns that compensate for higher rates. With houses selling as quickly as they have been, pricing continues to trend upward. This is especially exaggerated in urban markets, where low inventory can’t be easily compensated for by increased building (you can’t build where there aren’t empty lots!). The suburban markets are seeing these trends as well, though pricing is slowly starting to plateau as builders add to the inventory stock.

We may see a shift in mortgage product trends, as buyers try to protect themselves from what might be even higher rates down the line. The 3, 5, and 7 year Adjustable Rate Mortgages provide buyers with options a percentage point or two below fixed or long term rates, which helps offset the potential risk of rising rates in the short to mid term. However, with so many questions about rate trajectory – How high will they go? When does it stop? Will they come back down in 5 years? 10? – it’s even more important to discuss your options with a trusted mortgage professional before locking anything in.

Summary

All this said, we see moderately increased rates as a reflection of a strong economy and a booming real estate market. And while low rates were fun while they lasted (that 30 year fixed mortgage at 3.5% was a no brainer), mildly costlier borrowing is ultimately a small price to pay for a healthy, stable market whose upward equity potential is likely to benefit the savvy, informed shopper.

As the saying goes: “A rising tide lifts all boats.”

If you’ve been paying attention to Richmond’s real estate market over the last year or two, you’re no stranger to the concept of a bidding war. With low inventory and high competition, this is something we have become very familiar with. Whether you’re buying or selling – or both – it’s important to understand how bidding wars are created and the best ways to navigate these sometimes rocky waters.

If you’ve been paying attention to Richmond’s real estate market over the last year or two, you’re no stranger to the concept of a bidding war. With low inventory and high competition, this is something we have become very familiar with. Whether you’re buying or selling – or both – it’s important to understand how bidding wars are created and the best ways to navigate these sometimes rocky waters. Sometimes sellers want to hike up the price of their home, even when they know it’s worth less. Their thinking is to aim high and then, even if they have to compromise a bit, they still make what they’re hoping to make. The problem with this strategy, as a seller, is that the right audience never sees the home: the people who can afford it generally want something with better or more features and the people who have a smaller budget are discouraged by the price and cross it off their list.

Sometimes sellers want to hike up the price of their home, even when they know it’s worth less. Their thinking is to aim high and then, even if they have to compromise a bit, they still make what they’re hoping to make. The problem with this strategy, as a seller, is that the right audience never sees the home: the people who can afford it generally want something with better or more features and the people who have a smaller budget are discouraged by the price and cross it off their list.

Seriously. We are happy to serve as a trusted resource in the months or years before you’re ready to take the plunge.

Seriously. We are happy to serve as a trusted resource in the months or years before you’re ready to take the plunge. From our knowledge of market caps, neighborhood trends or expectations, experience through countless appraisals – you name it – we can help you get the most bang for your buck when it comes to making sure investments made in your home will pay off down the road.

From our knowledge of market caps, neighborhood trends or expectations, experience through countless appraisals – you name it – we can help you get the most bang for your buck when it comes to making sure investments made in your home will pay off down the road. Want to be in the know? Come on, who doesn’t?

Want to be in the know? Come on, who doesn’t? Easy as 1, 2, 3 … 4, 9, 37, 142, 359 … Wait, this is Hard!

Easy as 1, 2, 3 … 4, 9, 37, 142, 359 … Wait, this is Hard! But if you’re building a new home in Virginia, every new home is required to be warranted by the builder. And for good reason! Poor workmanship is a lot bigger of a deal than a glitchy iPhone or a car that prematurely breaks down.

But if you’re building a new home in Virginia, every new home is required to be warranted by the builder. And for good reason! Poor workmanship is a lot bigger of a deal than a glitchy iPhone or a car that prematurely breaks down.

I once heard an auctioneer say that any time two people are in the same room at the same time trying to buy the same thing, the seller gets market value. Put a third into the mix, and the seller is likely to get above market.

I once heard an auctioneer say that any time two people are in the same room at the same time trying to buy the same thing, the seller gets market value. Put a third into the mix, and the seller is likely to get above market.