When you decide to buy a used car, you don’t base your purchasing decision on cosmetics. You might have a color preference or want certain safety features, but the primary consideration lies in where the car has been and how well it’s been taken care of.

Has it been in any accidents or had major body work done?

Has it ever been in a flood or fire?

What system replacements did the previous owners make?

How many miles are on it?

Was it serviced routinely?

These qualifying questions come to mind so easily and I haven’t even bought a car in years. So why don’t we approach real estate with the same mentality? Problems with your house are arguably more inconvenient and definitely more expensive to repair, so why not demand the same record keeping when it comes to buying a home?

I would argue that as a buyer, you’d be silly not to look into all the maintenance records provided by the seller, and as a seller, you’ll give yourself a huge advantage by keeping detailed records from the day you buy your home to the day you go to resell it.

Let’s start with the why

From the seller perspective, you might be thinking, ‘if buyers don’t really pay attention, then why keep these types of records?’

From the seller perspective, you might be thinking, ‘if buyers don’t really pay attention, then why keep these types of records?’

The answer is that, as the market slowly shifts from being a sellers’ market to a buyers’ market, buyers will become more and more discerning when it comes to their purchases. With inventory as low as it is right now, sellers don’t have to do too much to make their home appealing to buyers, because buyer competition is high and they’ll take what they can get. But once that changes, sellers will need to go above and beyond to get an upper hand.

Buying a home is an emotional decision, and fear can play a big role in that. So in a case where a buyer is choosing between a couple homes that are all pretty similar, being able to pass over an organized maintenance and repair record instills confidence in the buyer that, by choosing to purchase your home, they’re not signing on for any unexpected system breakdowns from poor maintenance over the years. And when competition among sellers is high, that can make the difference.

If that weren’t enough of a reason, any seller’s agent worth his or her salt will take all of that information into account when pricing your home! You can justify a higher price tag when it’s clear that the home is well maintained. People will pay for peace of mind.

Moving on to how

When it comes to this type of record keeping, you don’t have to get fancy. Receipts are great if you can keep them organized, but something as simple as a list of services and dates is plenty to be able to pass over to a buyer or his/her agent as proof that the home was well cared for.

Something else that goes a long way? Photographs. Before and after photos can be helpful, particularly with big ticket cosmetic items, to demonstrate visually the impact of certain repairs along the way.

Maintenance plans

The easiest way to keep up on some of these items is to get on a maintenance plan. Usually for just a small annual fee, someone will come check for termites or open up your HVAC and take a look around. That way, you get peace of mind knowing that everything is getting checked on at least once or twice a year. And, as is the case with cars, fixing small problems is a lot cheaper than when they grow up to be big problems!

Another benefit of being on a maintenance plan is that, if something does go wrong, servicing your system is often prioritized over people who are calling with an issue for the first time in years. And when everyone’s air conditioning starts breaking on the hottest day of the year, you want yours to be a top priority for repairs!

Major items to keep in mind

This isn’t an all encompassing list, but these are the systems that need routine love and attention.

HVAC – If you don’t keep up on your HVAC system, it will give out, and it will probably do so on the hottest (or coldest) day of the year. Plus, most warranties require routine maintenance, so even if your system is brand new, someone needs to be checking up on it.

Pest control and termite prevention – An insect problem, particularly a termite problem, can escalate very quickly, and keeping bugs away is so much easier than getting them to leave. Whether you’re getting your house bombed or just having someone come inspect the perimeter of your home for potential infestations, a little goes a long way.

Sprinkler systems – If you’re selling your home in the winter months, these can’t always be tested to prove their functionality to buyers, so having proof that your sprinkler system was serviced routinely over the years is really the only way a buyer can trust there won’t be an issue when springtime comes around.

Sprinkler systems – If you’re selling your home in the winter months, these can’t always be tested to prove their functionality to buyers, so having proof that your sprinkler system was serviced routinely over the years is really the only way a buyer can trust there won’t be an issue when springtime comes around.

Chimney and fireplace – Even with gas burning fireplaces, dirt, debris, and even animals (yes, it happens all the time!) can get stuck in your chimney and wreak havoc.

Roofing and gutters – Whether you’re taking care of this yourself or hiring a professional to climb up there and get their hands dirty, keeping wet leaves off the roof and out of the gutters ensures that water isn’t building up anywhere it can damage the foundation or create a mold problem on the roof. And since a mold problem anywhere usually becomes a mold problem everywhere, this is worth keeping up on.

Air ducts – This is important not only to make sure you’re not breathing in dust and bacteria everyday, but because keeping air ducts clean also helps keep your HVAC system clean. Win – win.

Plumbing – This is not a system that you want to have issues with. Even if it’s just a quick search for active leaks and a hot water heater check up, hiring a plumber once or twice a year is a wise decision.

Additional Resources

I know, all of this sounds intimidating, but seriously, a little bit goes a long way. And you’ll be glad you stayed on top of things when it comes time to resell your home. Or at least, your realtor and potential buyers will!

Here’s what I suggest. Check out the resources below and either create your own checklist or download one of the ones provided. Keep it on your fridge and just tackle one item at a time. Besides, maintenance plans will take care of a lot of this for you!

Better Homes & Gardens’ Maintenance Checklist

The New York Times’ Maintenance Checklist

Mr. Handyman’s assorted list of printable maintenance schedules

Particularly in Richmond, home values are continuing to rise, making real estate an investment that is likely to produce returns that compensate for higher rates. With houses selling as quickly as they have been, pricing continues to trend upward. This is especially exaggerated in urban markets, where low inventory can’t be easily compensated for by increased building (you can’t build where there aren’t empty lots!). The suburban markets are seeing these trends as well, though pricing is slowly starting to plateau as builders add to the inventory stock.

Particularly in Richmond, home values are continuing to rise, making real estate an investment that is likely to produce returns that compensate for higher rates. With houses selling as quickly as they have been, pricing continues to trend upward. This is especially exaggerated in urban markets, where low inventory can’t be easily compensated for by increased building (you can’t build where there aren’t empty lots!). The suburban markets are seeing these trends as well, though pricing is slowly starting to plateau as builders add to the inventory stock. If you’ve been paying attention to Richmond’s real estate market over the last year or two, you’re no stranger to the concept of a bidding war. With low inventory and high competition, this is something we have become very familiar with. Whether you’re buying or selling – or both – it’s important to understand how bidding wars are created and the best ways to navigate these sometimes rocky waters.

If you’ve been paying attention to Richmond’s real estate market over the last year or two, you’re no stranger to the concept of a bidding war. With low inventory and high competition, this is something we have become very familiar with. Whether you’re buying or selling – or both – it’s important to understand how bidding wars are created and the best ways to navigate these sometimes rocky waters. Sometimes sellers want to hike up the price of their home, even when they know it’s worth less. Their thinking is to aim high and then, even if they have to compromise a bit, they still make what they’re hoping to make. The problem with this strategy, as a seller, is that the right audience never sees the home: the people who can afford it generally want something with better or more features and the people who have a smaller budget are discouraged by the price and cross it off their list.

Sometimes sellers want to hike up the price of their home, even when they know it’s worth less. Their thinking is to aim high and then, even if they have to compromise a bit, they still make what they’re hoping to make. The problem with this strategy, as a seller, is that the right audience never sees the home: the people who can afford it generally want something with better or more features and the people who have a smaller budget are discouraged by the price and cross it off their list. Have you ever heard someone say “kitchens and bathrooms sell houses”?

Have you ever heard someone say “kitchens and bathrooms sell houses”?

Seriously. We are happy to serve as a trusted resource in the months or years before you’re ready to take the plunge.

Seriously. We are happy to serve as a trusted resource in the months or years before you’re ready to take the plunge. From our knowledge of market caps, neighborhood trends or expectations, experience through countless appraisals – you name it – we can help you get the most bang for your buck when it comes to making sure investments made in your home will pay off down the road.

From our knowledge of market caps, neighborhood trends or expectations, experience through countless appraisals – you name it – we can help you get the most bang for your buck when it comes to making sure investments made in your home will pay off down the road. Want to be in the know? Come on, who doesn’t?

Want to be in the know? Come on, who doesn’t? Now, we’re not saying that everyone should pull a Chip and Joanna and buy a place that needs to be taken down to the studs. What you can do is consider a house that might not fit every item on your checklist. Maybe it’s the right house, but the kitchen is dated. Or the bathroom needs some updates. Maybe the roof or HVAC has lived its life and you won’t have the cash post-closing to pay for a large project like that. Don’t let these kinds of “issues” scare you. Focus on finding a property that meets your needs on things that can’t be changed – location, layout, and overall size, and try to turn a blind eye to that pink tile in the master bathroom.

Now, we’re not saying that everyone should pull a Chip and Joanna and buy a place that needs to be taken down to the studs. What you can do is consider a house that might not fit every item on your checklist. Maybe it’s the right house, but the kitchen is dated. Or the bathroom needs some updates. Maybe the roof or HVAC has lived its life and you won’t have the cash post-closing to pay for a large project like that. Don’t let these kinds of “issues” scare you. Focus on finding a property that meets your needs on things that can’t be changed – location, layout, and overall size, and try to turn a blind eye to that pink tile in the master bathroom. Easy as 1, 2, 3 … 4, 9, 37, 142, 359 … Wait, this is Hard!

Easy as 1, 2, 3 … 4, 9, 37, 142, 359 … Wait, this is Hard! But if you’re building a new home in Virginia, every new home is required to be warranted by the builder. And for good reason! Poor workmanship is a lot bigger of a deal than a glitchy iPhone or a car that prematurely breaks down.

But if you’re building a new home in Virginia, every new home is required to be warranted by the builder. And for good reason! Poor workmanship is a lot bigger of a deal than a glitchy iPhone or a car that prematurely breaks down.

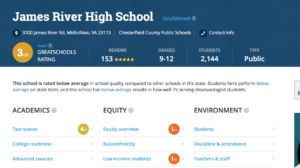

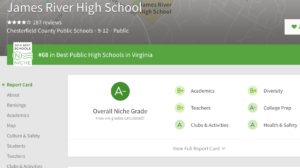

As realtors, we cannot recommend one school district over another, but we can help make sure you’re considering all the factors when it comes to schools.

As realtors, we cannot recommend one school district over another, but we can help make sure you’re considering all the factors when it comes to schools.