“Should we use a realtor?”

I get asked this question occasionally, especially in a strong seller’s market like we have right now. The hard data out there is clear: when you try the ‘do-it-yourself’ approach, you put yourself at a clear statistical disadvantage and have a much higher chance of not selling. And, those that do sell often end up selling at a discount more costly than hiring a realtor. But that’s not what I want to focus on here.

Coming from someone who, many years ago, tried (and failed) to sell for sale by owner (FSBO) before ultimately hiring a realtor, then becoming one, I can now clearly see both sides of the issue. I ultimately misjudged my abilities in some arenas and had total blind spots in others. I was oh-so confident at first: It all seemed straightforward! But I made the vital mistake of assuming that 98% of selling your home is finding a buyer.

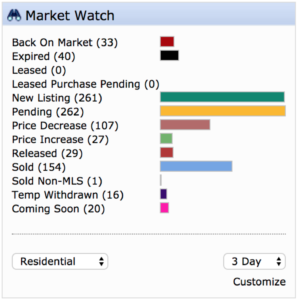

If successfully selling your home was just about finding a buyer then when Zillow stormed onto the scene years ago, FSBOs should have gone through the roof. But there are now fewer FSBO’s than before! As I write this in February of 2018, I’m looking at the data for the last 3 days in RVA, specifically ‘Sold’ vs ‘Sold Non-MLS’ (without realtor representation.) We can run this as 3 weeks, 3 months or 3 years, it always looks the same:

In a 3 day period, only 1 regional sale displayed as FSBO – that’s 0.65% of total sales.

My perspective changed drastically after I became a realtor, not because it was now my livelihood, but simply because of what I was witnessing day in and day out in the real estate world. Most of us know a police officer that is extra vigilant with the security of their own home, a doctor that is hyper vigilant when it comes to protecting themselves against germs and diseases, an EMT that would never< text and drive, or a firefighter that has coached their own children extensively on the dangers of fires. They have an inordinate amount of eyewitness experience in seeing how bad a situation can go when it does go wrong.

While I would not put us on the same level as these heroes in our community, the same goes for real estate. When I first started in the industry I was shocked to see how common it was for a transaction to turn into a costly and even deal-killing mess. Even when the buyer and seller both operate efficiently and on time, you can end up with major problems.

It can be something as simple as a foundation problem, or…

- a broken septic tank that needs to be replaced,

- an unknown underground oil tank,

- a leaking underground oil tank (hello EPA!),

- a substantial amount of moisture under the house,

- toxic black mold in the air ducts,

- zoning issues,

- structural issues,

- title issues,

- HOA violations,

- discovery of a previously undisclosed attic fire,

- dangerously high levels of radon,

- termite damage,

- the buyer’s lender majorly dropping the ball,

- pipes bursting days before closing,

- an improperly repaired roof that begins collapsing,

- appraised value coming in short,

- a combination of a dozen relatively minor issues that appear as a giant issue,

…and the list goes on and on.

And if you think this is an extreme example of rarely occurring problems, think again: These are all real examples from my first six months as a realtor!

Now enter those especially difficult buyers: Buyers trying to get you to fix every little nick and scratch in your house on the repair request addendum, even things that aren’t broken! Non-responsive buyers that are throwing off your timeline to close. Buyers who try to wiggle out of a contract so they can buy another house they love more than yours.

Think the buyer’s agent will help you out along the way? They are contractually obligated to represent the best interest of their client. Just like a judge that strongly advises someone against representing themselves in a court case, they know if they see you making critical mistakes or not objecting to something you have the right to object to, they legally can’t advise you otherwise.

And all of this is after you find a buyer. To get a buyer in the first place you need to hire a photographer ($300-$500, normally paid for by the realtor, and no, you and your iphone do not make for good photography), create printed marketing material for your house, implement social media marketing (more $$), and advertise in every newspaper and website you can think of since you will not be in the MLS system that agents rely on to find homes for their buyers.

Then there is the value of your time. And the value of your sanity! Buying and putting up signs, advertising for and holding open houses, follow-ups on those that showed interest, answering calls at work inquiring about your house, answering 100 other calls that waste your time (no, it is not for rent!)<, updating pictures and info on a dozen different websites, setting up and managing showing requests, getting feedback from showings, evaluating if a potential buyer’s pre-qualification letter is worth the paper it is written on, writing up and and negotiating contracts, handling deposits and escrow, finding and scheduling termite inspector, finding contractors to fix issues you didn’t know you had until inspection, sending a bajillion pieces of paperwork and emails back and forth to the buyer’s agent and to the attorneys, ordering HOA documents, scheduling appraisals, the final walk-through, the closing disclosures, the bank payoffs, ordering home warranties, scheduling closing dates and times.

And then continually adjusting your schedule through every hiccup in the process. Are you exhausted yet??

Here is my take:

A relatively competent and conciliatory seller with a decent property who accurately prices his or her home and is able to find a relatively competent buyer with reasonable expectations should be able to successfully sell their own house in a good market without representation as long there are little-to-no issues with the condition of the house or any other outside forces that would derail the process.

But how many transactions actually happen that smoothly? Conservatively, I would say 20%.

Your home is probably the most valuable asset you own, and you will spend at least one to two months hammering out the details of the most complicated legal transaction you will likely ever undertake.

Feel like rolling the dice?

I once heard an auctioneer say that any time two people are in the same room at the same time trying to buy the same thing, the seller gets market value. Put a third into the mix, and the seller is likely to get above market.

I once heard an auctioneer say that any time two people are in the same room at the same time trying to buy the same thing, the seller gets market value. Put a third into the mix, and the seller is likely to get above market. If we went to a cocktail party and asked everyone what it means to be green, we’d get so many different answers. Some would say it means reducing waste. Others would want to adopt conservation-minded technology, like solar panels. Some would say it means eating less meat.

If we went to a cocktail party and asked everyone what it means to be green, we’d get so many different answers. Some would say it means reducing waste. Others would want to adopt conservation-minded technology, like solar panels. Some would say it means eating less meat.

Market Value (or Fair Market Value)

Market Value (or Fair Market Value) Now how do the assessors calculate that value? Well, they bring in a whole bunch of factors: size, age, beds, baths and location, as well as sales price of other ‘similar’ properties. They throw all of it into a calculator (okay, that’s not true) and an assessment value comes out. What’s interesting is that the town, city, or county doesn’t have to be perfect. They just have to be decently close. Because their ultimate objective is to generate enough revenue without disturbing the collective peace. And they have to fund the budget. So it’s natural for tax assessors to prefer that tax rates rise to raise revenue—that responsibility falls on lawmakers—instead of increasing assessed value, in which the assessor is the bad buy.

Now how do the assessors calculate that value? Well, they bring in a whole bunch of factors: size, age, beds, baths and location, as well as sales price of other ‘similar’ properties. They throw all of it into a calculator (okay, that’s not true) and an assessment value comes out. What’s interesting is that the town, city, or county doesn’t have to be perfect. They just have to be decently close. Because their ultimate objective is to generate enough revenue without disturbing the collective peace. And they have to fund the budget. So it’s natural for tax assessors to prefer that tax rates rise to raise revenue—that responsibility falls on lawmakers—instead of increasing assessed value, in which the assessor is the bad buy.  What do lenders do with the appraisal? They use that value to figure out the maximum amount of money they will lend against the property. The less debt there is against the value of the home, the more secure the bank will feel, and they tend to lower the interest rate. As an example, a bank might want 5 percent on a loan that is 90% of the value of the property. That rate might sink to 4% if the loan is only 80% of the value. An important thing to know: the bank uses the appraisal value and technically doesn’t care what the agreed-upon sales price is.

What do lenders do with the appraisal? They use that value to figure out the maximum amount of money they will lend against the property. The less debt there is against the value of the home, the more secure the bank will feel, and they tend to lower the interest rate. As an example, a bank might want 5 percent on a loan that is 90% of the value of the property. That rate might sink to 4% if the loan is only 80% of the value. An important thing to know: the bank uses the appraisal value and technically doesn’t care what the agreed-upon sales price is. But one person bought two lots in that subdivision and planted a 6,000 square foot home with an in-ground pool, the finest details throughout, a three-car garage. They spent $700,000 to build it. Could they sell it for that much? What do you think?

But one person bought two lots in that subdivision and planted a 6,000 square foot home with an in-ground pool, the finest details throughout, a three-car garage. They spent $700,000 to build it. Could they sell it for that much? What do you think?